Rettinger Group Family Wealth

Private Wealth Management Services for Families

As a practice dedicated to serving High Net Worth families, we understand the unique challenges you face. You want to preserve your family’s wealth, leaving your legacy in good hands; a partner who educates, communicates, and coaches your family to live to your full potential. You’re looking for an advisory team that coordinates with all the professionals in your life, giving you time and space to focus on what matters most to you.

From bespoke wealth management solutions to personalized legacy planning, we're here to help navigate and elevate every aspect of our clients’ lives. Our client families live with confidence, knowing they have a partner committed to turning their aspirations into realities.

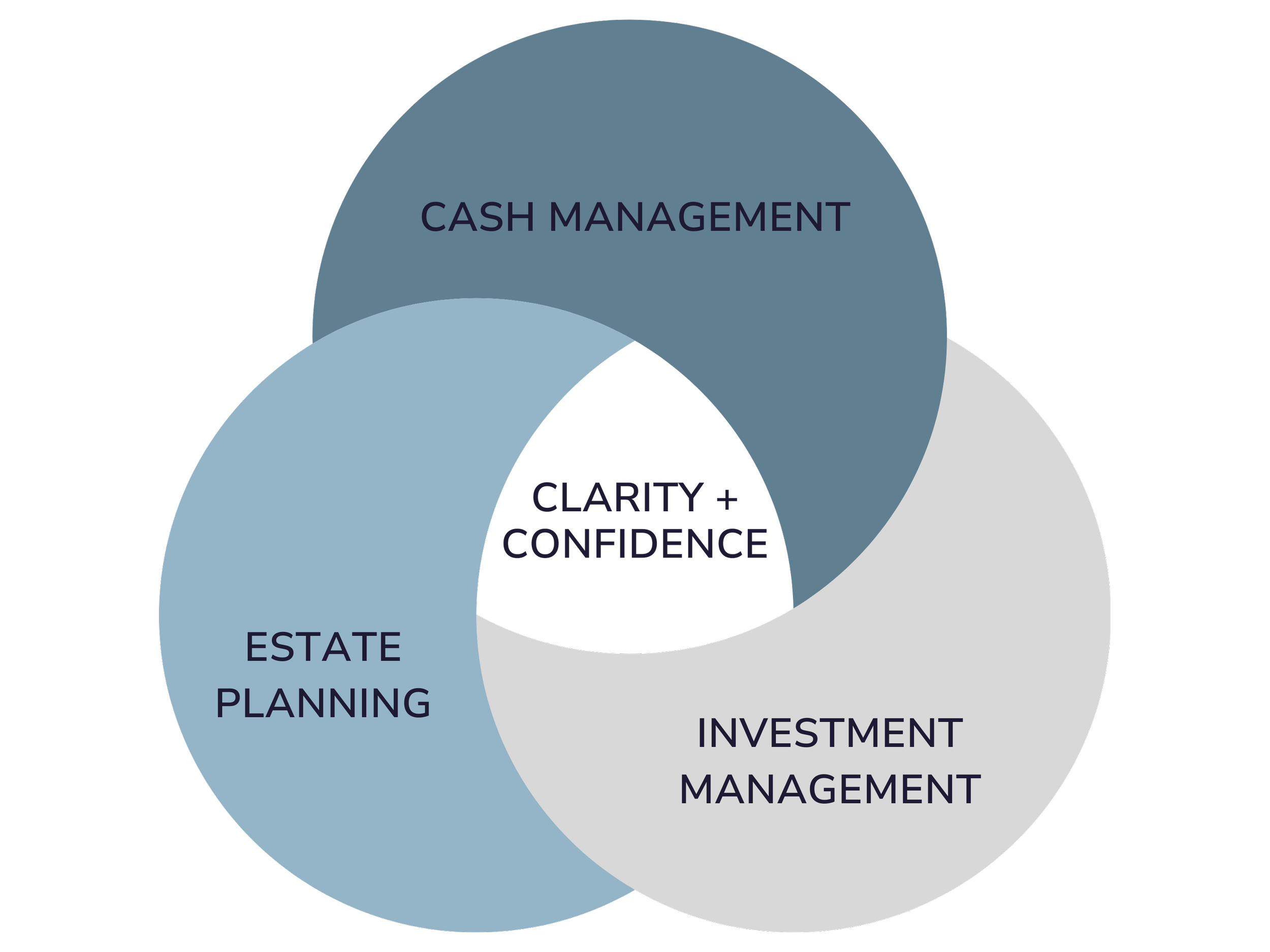

Comprehensive, integrated planning

Our planning approach centers on three key areas and the strategies that tie them together. At its core, our service brings clarity and confidence to client families. We emphasize clear education and open conversations, prioritizing financial literacy and cohesive decision-making. We aim to preserve and grow wealth through strategic investment planning and risk management. Our comprehensive estate planning services ensure a seamless transfer of wealth within the family, passing it down smoothly to future generations. Though our expertise is rooted in personal finance, our goal is to empower families, and help them find fulfillment.

Whitepaper: Vacation property succession planning

For many families, it is much more important to preserve the family cottage than any other asset. Those who want to leave the cottage to their children must plan for the tax consequences and disputes which may arise upon their death. The concepts here apply to any vacation property, including a ski chalet or condo.